17 October 2013 Carlos García Garzón

Energy Certificate of your home may vary your mortgage

Clearly the energy certificate is important and its proper performance should be a priority .

Some banks like Triodos Bank Debuts mortgages with differential improvement rating the higher the energy certificate of housing finance .

Homes more efficient , cheaper mortgages . This is the proposed new ” Ecohipoteca ” Triodos Bank , the first mortgage loan that ethical banking entity has launched in the Spanish market . Your offer of an interest of Euribor +2.10 % , has a maximum repayment term of 30 years and to finance 80% of the appraised value of the property ( from a minimum of € 50,000) .

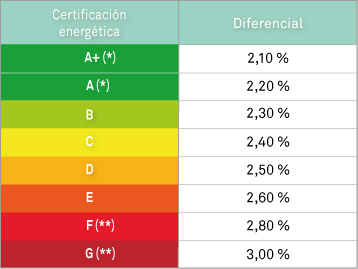

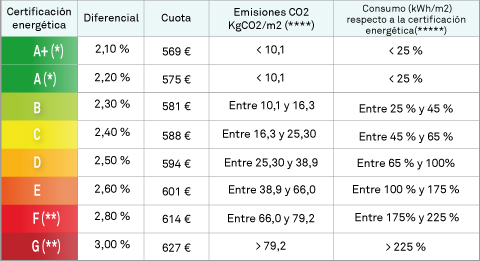

Now, get the lowest differential ( 2.10% ) depends on the energy performance certificate to have the house to be financed , ie the higher the energy rating of the home the lower the percentage that adds the Euribor .

energy rating A 2.10% to 2.20 %

energy rating B 2.30%

energy rating C 2.40%

energy rating D 2.50%

energy rating E 2.60%

energy rating F 2.80%

G energy rating 3.00%

Thus, today a consumer to request a mortgage of € 150,000 for a term of 30 years , would have to pay a fee of 602 € per month if your home has an energy rating A. However, if you only had a G , the mortgage would rise to € 675 per month , which would mean an extra cost of 876 € per year .

To enable their clients to access a loan with better differential , Triodos Bank will be included in the loan to finance the construction costs to improve the energy efficiency of the property .